Traditional retirement savings in the United States primarily revolve around 401(k) plans. However, many US employees are re-evaluating this old practice for a variety of reasons as unexpected competition emerges. Bitcoin, the leading cryptocurrency, is increasingly seen as a great savings technology.

Recent changes in the financial landscape highlight the rise of Bitcoin in the retirement savings debate and the reassessment of 401(k) plans amid heightened economic uncertainty.

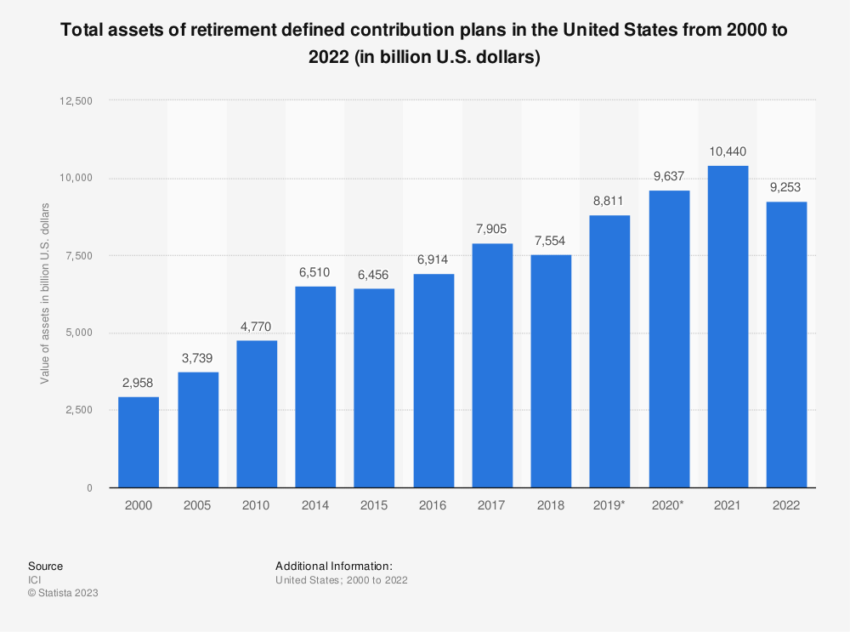

The Fading Appeal of 401k Retirement Plans

Decades ago, 401(k) planning emerged as a beacon of financial security, but recent events indicate a shift in sentiment. financial commentators deliberated Suspending contributions to your 401(k) account.

Reasons for this include the possibility of a bear market and lack of satisfying growth prospects, causing many to reconsider their investment strategies. Another factor is the high likelihood of fraud.

In fact, the Lincoln Police Department recently report A 67-year-old woman was defrauded of her 401(k) retirement benefits in a phone scam. She reportedly lost $52,000 to her scam. First, she was informed of unauthorized charges to her Amazon-linked bank account.

She spoke with a man on the phone, believing she was dealing with the bank’s fraud department. He persuaded her to drop out of her 401(k) in order to spend her two months buying bitcoin. Her crook promised to give her two of her checks totaling $69,999. However, these checks never arrived.

The incident further highlights the fragility of these savings plans. Even Sean Plummer, CEO of The Annuity Expert, highlight The real threat of losing money to a 401(k) account calls into question its advertised security.

“A 401k retirement plan can result in losses. However, it is important to understand that this does not mean all your money is gone forever. will go up and down over time,” Plummer said.

Bitcoin: A New Era of Employee Savings

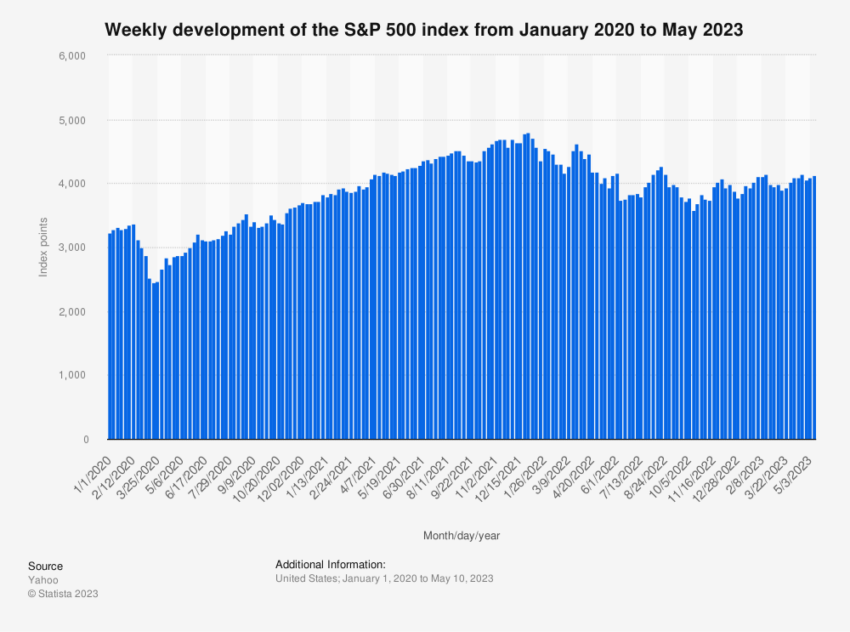

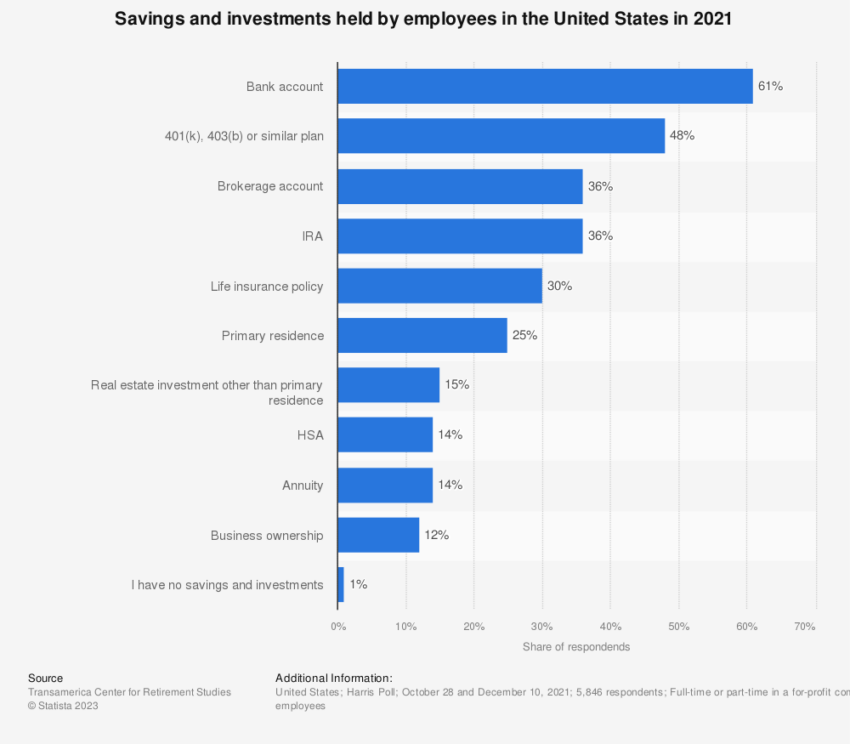

Amid these doubts about 401(k) plans, Bitcoin is entering the mainstream narrative.Recent report reveals the pros and cons of owning bitcoin in a 401(k) plan that is becoming the center of the retirement savings debate.

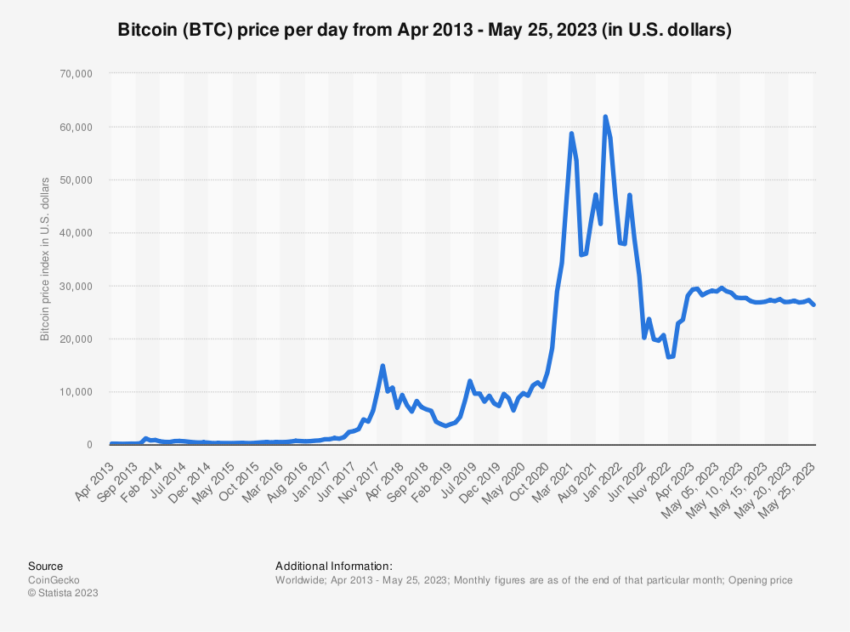

Born Fid Wealth founder Douglas Bornpurse has suggested that investors looking to allocate some of their retirement savings to cryptocurrencies should consider looking at Bitcoin. As the most prominent cryptocurrency, Bournepurse said, it offers less complicated opportunities for speculation.

Bitcoin is the preferred choice for the time being, as the inherent difficulties in dealing with other cryptocurrencies greatly increase.

Distinguished Financial Advisor Rick Edelman claim The inclusion of Bitcoin in 401(k) plans highlights the high return potential. He supports the possibility of investing in Bitcoin within his 401(k) plan.

As a result, the perception of cryptocurrencies is changing from a speculative asset to a viable investment option.

“[Including Bitcoin in a 401k retirement plan] This is very exciting and will be remembered as one of the original moments in the development of digital assets. Tens of millions of American workers will suddenly be able to invest in bitcoin due to the tax incentives and employer matching that many of them receive,” Edelman said. .

Edelman added that U.S. employees are adopting a dollar-cost averaging strategy by incorporating bitcoin into their 401(k) retirement plans. This strategy involves continuously investing a fixed amount from each paycheck over a long period of time.

Effectively mitigate volatility and create a more stable investment environment. According to Edelman, “This makes it an ideal place to buy bitcoin.”

Risks and Benefits of Bitcoin in Retirement Plans

Despite the growing interest in Bitcoin, including cryptocurrencies in a 401(k) plan is not without risks. “While volatile, it has significant upside potential.” Said Ivory Johnson, founder of Delancey Wealth Management.

Still, he added, most people react impulsively, often leading to short-term trading.

“People make decisions based on Twitter, hear something compelling…and they go all out and invest 30% of their retirement money in Bitcoin. [potentially] A bad situation has gotten exponentially worse,” Johnson explained.

Despite the risks, the potential benefits of Bitcoin in retirement plans seem to outweigh the potential drawbacks.

Some financial commentators have suggested that a Health Savings Account (HSA) may yield better returns than a traditional 401(k). According to recent information, report, HSA can be at least 17% better than 401(k). However, Bitcoin’s high return potential suggests that Bitcoin may outperform both his HSA and 401(k).

As a digital asset that operates independently of the traditional financial system, Bitcoin offers freedom and potential returns that traditional savings technologies have difficulty matching.

Strike CEO Jack Mullers claims Bitcoin is gaining ground as a good alternative to 401(k) retirement plans.

“In terms of money, I think Bitcoin is a great saving technology. It is the best designed money in human history. We use money to do things, we use money to trade things, so money contains everything, and I think that’s the use case for bitcoin, which is an asset, and as a financial instrument, it’s an excellent It’s a big payment,” Mullers said.

The Future of Savings: Dollar Cost Averaging

Growing interest in Bitcoin among US employees suggests a possible paradigm shift in retirement savings. While traditional 401(k) plans were once considered the gold standard for retirement preparation, the advent of cryptocurrencies has created new possibilities for financial security.

With its potential for high returns and independence from the traditional financial system, Bitcoin has been embraced as an excellent savings technology.

As we continue to explore the pros and cons of Bitcoin as a retirement savings option, it becomes clear that this digital asset is already beginning to disrupt traditional financial planning strategies.

A revolution around retirement savings is underway, led by the pioneering spirit of Bitcoin and its adopters.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts and individuals. While BeInCrypto is dedicated to providing transparent reporting, the views expressed in this article do not necessarily reflect those of his BeInCrypto or its staff. Readers should independently verify the information and consult their professional advisors before making decisions based on this content.