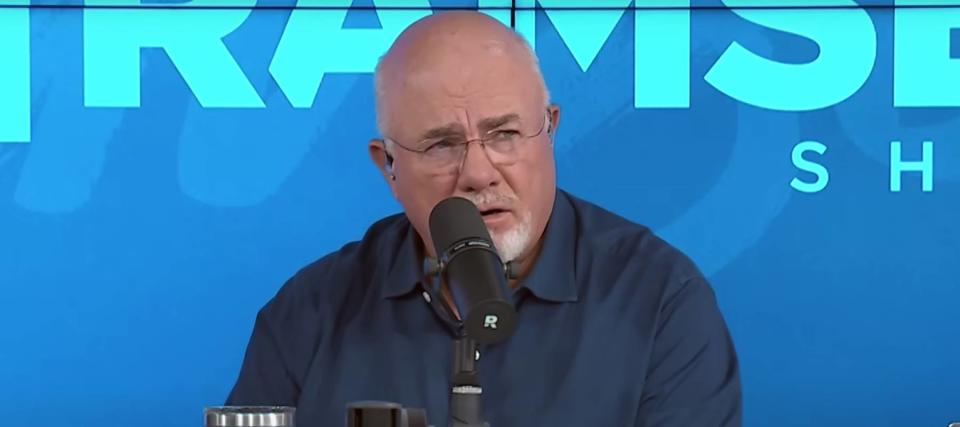

Dave Ramsey is up for it again. Believe it or not, he’s more opinionated and cocky than the guy from Philadelphia.

Do not miss it

‘Dave from Philadelphia’ told financial guru on recent Ramsey show episode He said he “barely lives” on a household income of $180,000. He wasn’t sure whether to save more or take out a loan to make ends meet.While his wife’s numbers will go up once she graduates from medical school (she’s currently earning $70,000 as a resident), the family of four Debt and payment dispute.

In keeping with his trademark style, Ramsey voted for another pick.

“Option ‘C’, work more,” he said, adding, “Can you explain why you can’t live on $180,000?” he asked. “I’ll try to be as kind as I can, Dave. You guys have lost your mind.”

Monsters under the children’s beds (expenses)

Forced to dig even deeper, the Philadelphia native Dave revealed his child’s expenses that raise eyebrows. That would require at least $50,000 in preschool tuition for two children, preschool and afterschool care, and nanny payments during the summer.

Perhaps you are thinking of what Ramsey said. “Are they going to Harvard?”

The man admitted that it’s a pretty posh school there, especially considering his kids are still in preschool age. In fact, according to parenting websites, the average Pennsylvania childcare cost is still just over $17,000 per child, and slightly higher in suburban areas. Tootrice.

“I’m going to take out a student loan for my 4-year-old,” Ramsey teased. “That’s what we’re ultimately aiming for.”

First, budgeting for cost-effective childcare is even more important when you consider expenses such as gasoline, insurance, groceries, and utilities that many Americans cannot easily avoid. budget plays an important role Especially when you start by tallying up your spending over the last three months, you’ll be able to keep things under control.What is the most expensive? What is non-negotiable? Where can I do it? Painless, streamlined cut will it be made?

read more: Here are the average household incomes of the American middle class — How do you stack them?

What about Ramsey’s “Option C”?

Income from additional work could offset the dollar amount of the loan, as Ramsey suggested. Ramsey basically does not dabble in loans, start a side business Alternatively, just taking a part-time job while building an emergency fund could give you a numbers advantage.

These days, a side hustle can be as simple as renting out your shed as a warehouse. A 10-foot-by-10-foot unit in Philadelphia could generate about $160 in revenue, according to Rent Cafe. WhereiPark says that if you have an unused parking space, you can rent it out for about $300 a month. With these two moves he makes over $5,500 a year.

When to Consider a Loan

Philadelphia native Dave clearly needed reality checks for his child’s “Harvard University” child support. However, his wife has zero medical school debt, which means her $180,000 income means a relatively small financial burden, according to the U.S. Census Bureau, as of 2021. more than double the average household income of $71,000.

So, for the time being, does it make sense to combine cost savings with lower loan amounts? Maybe — but only if you start with Avoid high interest credit cards as a source. If you are considering a personal loan, to shop. Banks and other financial institutions need your business, so let them compete to offer you the best interest rates.

Of course, a married person on a neutral party stance should, in this case, professional financial advisor — You get a clearer picture when it comes to distinguishing needs from wants and waste. After all, no one wants to stay in an economical preschool.

what to read next

This article is for information only and should not be construed as advice. It is provided without warranty of any kind.