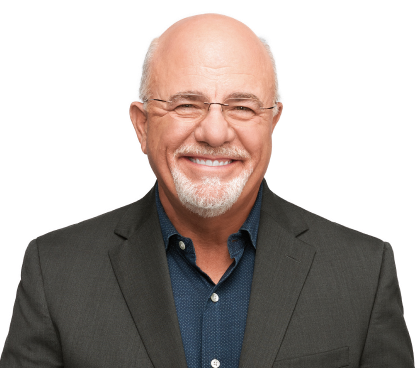

It’s easy to blame us money troubles Due to external economic influences, healthy personal finances are determined by motivation and mindset. Solving the situation means taking responsibility for your situation. financial decisions and conscious choices Because he’s a financial advisor and a popular radio and podcast host. Dave Ramsey “Money isn’t just a math problem. It’s a behavioral problem.”

Money expert Jaspreet Singh: Get rich with these 3 investments

look: 9 safe investments that will give you the best returns

“Only 20% of your head knows about personal finance,” Ramsey tweeted yesterday. “The other 80 percent, or the bulk of the problem, is behavior. Our actions regarding money can get us into the most trouble Or lead us to maximum success. ”

Ramsey Shaw supports his father’s point of view Co-sponsored Rachel Cruz says: “If you want to get to the root of why you do what you do, why you spend, save, borrow, or put off investing, how does the psychology of money affect you?” You have to learn how to do it. “

Of course, every individual’s financial situation is different depending on many factors such as income and debt, cost of living, and financial goals, but inappropriate spending and saving behaviors are common to all, leading to better self-discipline. can be overcome by practicing your money.

Here are 5 bad ways to save money. Wasteful Habits You Can Stop Today:

1. Controlling discretionary spending

The gap between living and living well is always closing. The non-essentials and wants need to take a hit as the prices of the necessities are higher than ever and saving and paying off debt is more important than ever.

Even in the best of times, the focus should be on cutting discretionary spending on entertainment, hobbies, leisure and travel. Resisting impulse purchases, discounts, and getting rid of unused streaming platforms and meal delivery services will give you more money to save, pay off debt, and invest. If you pause before buying non-essentials, most discretionary spending will prove to be worth the wait.

2. Poor budgeting

whether to use 50-30-20 rule Or, if you relentlessly track all the money that comes and goes, it’s imperative to have a budget, stick to it, and review it regularly to manage short-term spending and meet long-term needs.

Small changes, such as premium rate increases, can dilute funds from other pressing obligations. Therefore, choosing a system and monitoring it frequently is essential to have a clear understanding of your goals and how to reach them.

3. Not saving for the future

Constant pressure to spend can create bad money habits and derail your financial future. “Living in the present moment” is a noble intention, but doing so can damage every future moment life brings.

We have always had to choose between spending and saving and will continue to do so. But making wiser decisions now will greatly benefit you and your loved ones in the future.

By taking small steps such as automatically transferring a portion of your salary to your savings account, cutting costs wherever possible, supplementing your income, or funding your retirement account, you can help us buy a home or send our children to college. You can secure funds that can reliably meet future large expenses such as. I am simply enjoying my retirement.

4. Avoid Saving Emergency Funds

For money pundits like Ramsey, who advocate basic wealth building based on savings and debt-free living, all the money that would normally be spent on discretionary purchases should be spent paying off debt and building an emergency fund. is.

Most experts believe that you should have enough money in your emergency fund to cover at least three to six months of living expenses. Some believe that given the current economic climate, we should strive for a nine-month emergency stay-at-home order. Either way, start by estimating the cost of your critical expenses (the costs you’ll need if you lose your job or have a catastrophe) and scale it up as needed. The point is, you started saving something.

5. Rely on credit cards

The average credit card balance increased by 13.2% last year due to higher credit card interest rates and spending, bringing the average balance in 2022 to $5,910. Experian. Total credit card balances increased by $125 billion to $910 billion by the end of Q3 2022.

We all know that credit cards are traps. It’s useful in some cases, but it’s still a trap. Getting out of card debt takes self-control, but it can be done if you control your usage, pay more than the minimum amount, and use your budget to regulate credit card purchases.

learning: 22 side jobs that can make you richer than a full-time job

I became a self-made millionaire: These are the investments everyone should avoid during a recession

Just as better nutrition and exercise improve health, there is no downside to improving personal finances through smarter spending and saving behavior. It’s up to you to change your behavior and break bad habits faster.

Learn more about GOBankingRates

This article was originally published on GOBankingRates.com: Dave Ramsey Says ‘Money Isn’t Just Math, It’s Action’ — 5 Bad Habits to Stop Today