Wynn McNamee/Getty Images News

Dangerous for various reasons

The main risks are Tesla (Nasdaq: TSLA) is an assessment that seems disconnected from reality as misconceptions swirl around Tesla’s self-driving cars, EV semi-computers and superchargers. On the other hand, the main risks are ford motor company (New York Stock Exchange: F) is leverage. Let’s dig in.

Ford’s Leverage Compared to Tesla

First of all, you should understand that Ford has a large financial business compared to Tesla. Ford Credit provides financing to customers in the form of loans and leases. The company also provides loans to Ford dealerships to help cover inventory and high operating costs. These are all leveraged and inherently risky. But Ford is paid in the form of interest for the risks it takes (like a bank).

Tesla also offers loans and leases in some jurisdictions. At the same time, it relies on financial institutions for third-party funding. Tesla does not appear to lend to dealers, but instead sells vehicles through its website and “company stores.” I like this business model because it is less leveraged. But can Tesla grow to the size of Ford or General Motors?GM) use this business model. I don’t know this yet.

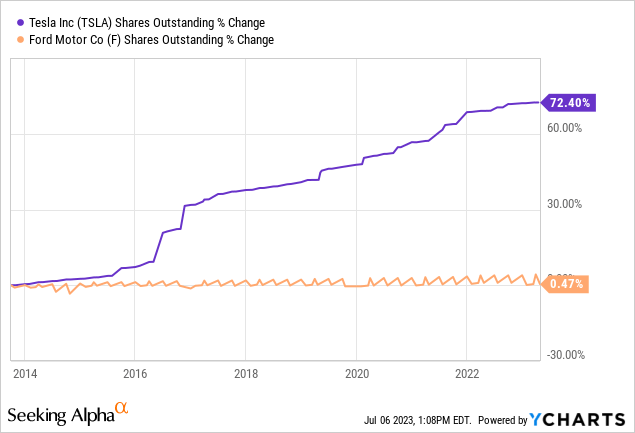

Tesla’s business model is also enabled by stock dilution, which raises cash from investors.

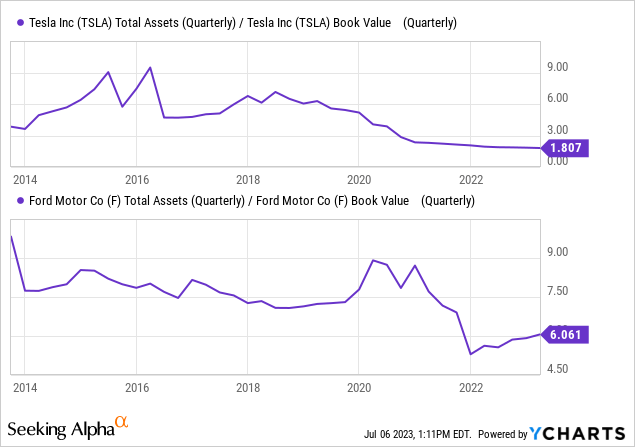

Due to Tesla’s business model and stock dilution, it has a better balance sheet on an asset-to-capital basis (lower number means less risk).

When equity is greater than liabilities and assets, it becomes more difficult for shareholders (you) to be wiped out by recession losses.

Notice how both of these companies have de-risked their balance sheets over the past decade. Still, Ford’s balance sheet is more leveraged than many of its competitors.

| Automaker ______ | From assets to capital |

| ford | 6.1 |

| general motors | 3.6 |

| Volkswagen (OTCPK:VWAGY) | 3.1 |

| Stellantis (STLA) | 2.6 |

| Toyota (TM) | 2.5 |

| Honda (HMC) | 2.1 |

| Tesla | 1.8 |

Looking at US bank and automaker balance sheets, I think the next recession in the US will be much less severe than the one we saw in 2008.Looking at just the asset-to-equity ratio, GM’s ratio is 17 in 2004.Ford’s 18. So Ford’s leverage is now one-third.

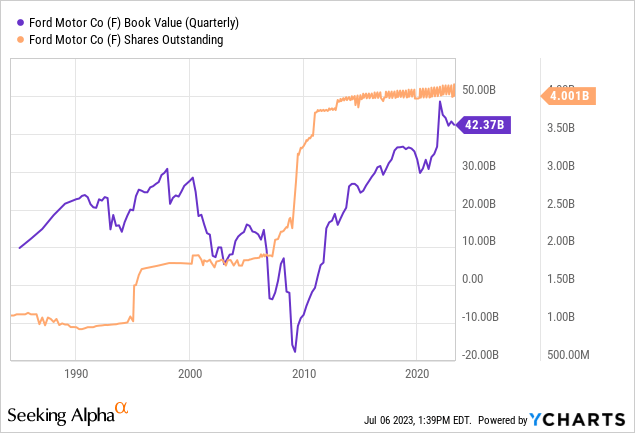

From 2005 to 2009, Ford’s shareholders’ equity actually turned negative as losses began to mount.

General Motors went bankrupt, but the only reason Ford survived was because it greatly diluted its shareholders. Could Ford again experience losses and declining stockholders’ equity? Yes, it could, but there are risks. But will the company’s capital be at risk, as it was in 2008? I doubt it will happen anytime soon.

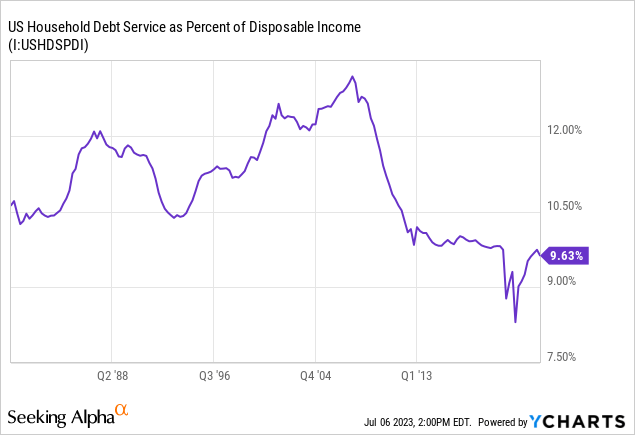

Relative to income, US household debt has become more affordable than ever.

with Ba2 (equivalent to BB), the real risk for Ford, which has adopted a “junk bond” credit rating, would be a deterioration in its competitive position along with a poorly rated balance sheet. Ford runs a highly cyclical business and operates with one of the worst balance sheets of any major auto company.

Tesla risk

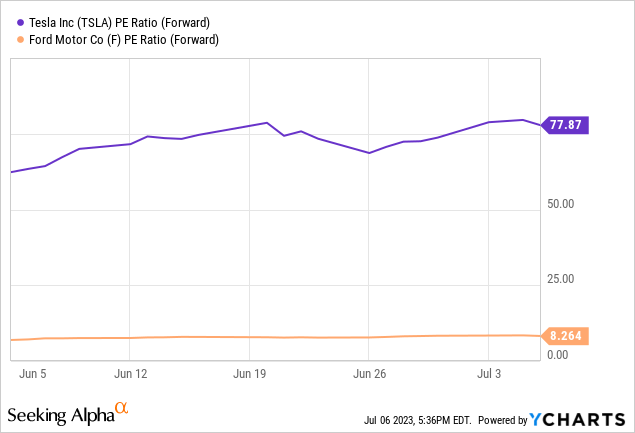

Tesla is at risk because its valuation is decoupled from its potential growth prospects. Let me explain.

Contrary to popular opinion, Tesla actually loses in the self-driving space. Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY) recently became the first company to be licensed. level 3 Autonomous driving in the US On the other hand, Ford and Tesla are still only capable of Level 2 autonomy. Guidehouse Insights analyst Sam Abuelsamid recently said: Said:

“Tesla’s technology is a joke. It’s nowhere near as good as a human being behind the wheel, watching over it, and operating without ever being ready to take over. It’s as decent as Supercruise or Ford’s Blue Cruise. It’s a level 2 system.” ”

This disagrees with fund manager Cathy Wood. Claim or

“The robo-taxis opportunity will bring in $8 trillion to $10 trillion in revenue by 2030 worldwide.”

Kathy Wood’s Tesla analysis makes no sense at all. To put this crazy number into context, Walmart (WMT), the number one company in the world by revenue, has just $600 billion in sales (15% of what Kathy claims). 1). In the meantime, I see the following headlines:

headline (Yahoo Finance)

Also, Tesla is currently AI robot Select an item from the table:

tesla bot (Tesla)

That’s great, but I think it’s doing more of the heavy lifting in boosting the valuation of Tesla stock than in creating economic value.

We’ve seen Amazon (AMZN) push into exciting new areas like the Fire Phone and Amazon Alexa before, but only headlines like this make headlines a few years later.

article title (extreme tech)

So we don’t know which Tesla venture will generate more cash flow than it will eventually consume.

Elon Musk claimed that Tesla’s electric semi truck has a range of 500 miles. However, according to CNBCA Tesla EV semi-semi has been spotted breaking down around Northern California. And there seems to be a question of how much weight the truck can carry. Pepsi uses trucks to deliver light bags of chips 425 miles, but the company limits its heavy soda cans to short distances. As with EVs, BYD Company Limited (OTCPK:BYDDF) is a big competitor in this area as well. There are also Daimler. I think this could be profitable for Tesla, but I don’t think it’s going to be very profitable. This market is not as big as the small car market.

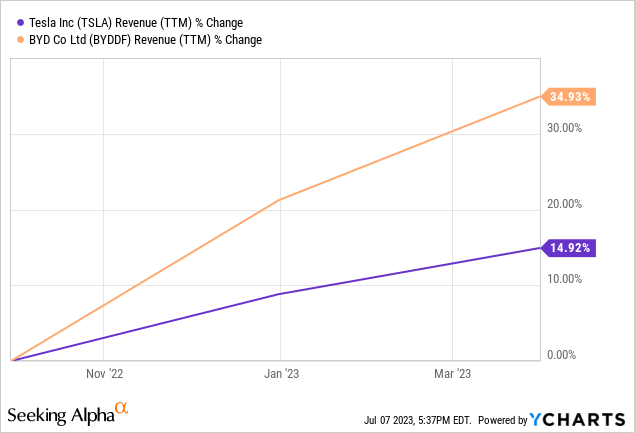

Looking at the EV space, issues such as low profit margins, limited infrastructure, mass adoption by BYD and ICE automakers, consumers preferring hybrids, and government subsidies that will likely dry up as EVs become the norm. I can see it. I don’t have time to go into detail on each of these, but in my opinion they represent risks. for example, Fortune Business Insight and Vantage market research The EV market is expected to grow at around 17.5% annually through 2030 (after which growth may slow down). BYD, on the other hand, is growing faster than Tesla.

And Tesla’s market share and margins are likely to face further pressure as consumers begin to realize that their favorite ICE car brand is offering much cheaper EVs.

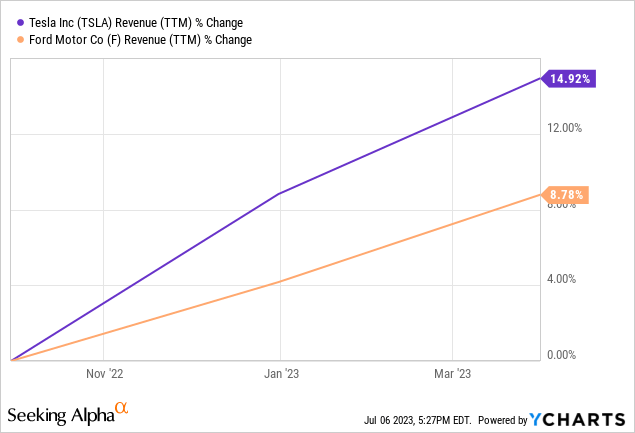

Over the past year, Tesla’s earnings haven’t grown as fast as Ford’s.

Finally, using only estimates, $3 billion With revenues likely to rise by 2030, Tesla’s EV charging partnerships (with Ford, GM, and others) could be just a drop in the bucket for long-term profitability.

long term benefits

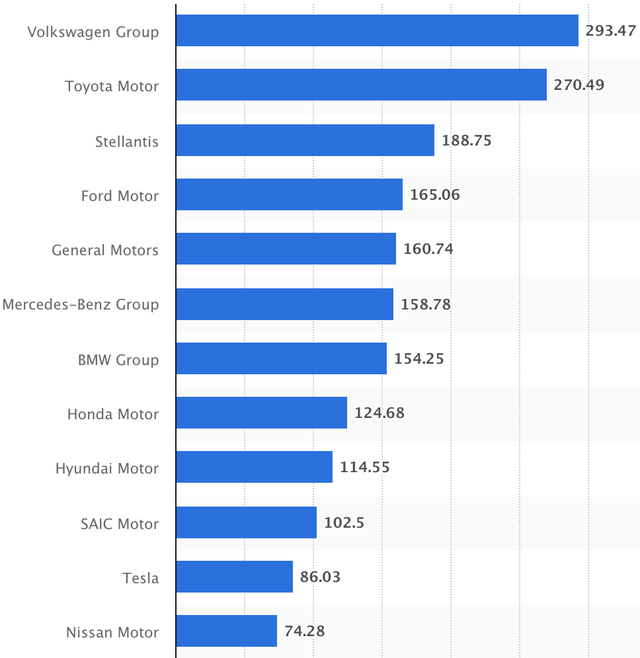

Tesla certainly has room to gain global market share and I see it growing much faster than Ford going forward. Global earnings in 2022:

Global Sales by Automaker 2022 (Statista)

But Ford is trading at such a deep discount to Tesla that I believe Ford is doing more than 8.5% annualized total return over the next 10 years, while Tesla is down 1.5% annually. (My 2033 stock price target is just $240 for TSLA).

| _________________________________________ | TSLA | F. |

| Normalized EPS | $3.40 | $1.60 |

| current dividend | $0 | $0.60 |

| compound annual growth rate | 15% | Four% |

| EPS in its 10th year | $13.75 | $2.37 |

| multiple terminals | 17.5 times | 10 times |

| 10th year target price | $240 | $23.7 |

| Annual return (Dividend reinvestment) | (1.5%) | 8.5% |

Note: This is a basic estimate. The compound annual growth rate covers dividends and earnings. Diluted EPS was used to calculate Tesla’s normalized EPS. Ford’s calculations used his 10-year average ROA and profit margins for the company and applied them to the current asset base and his TTM earnings. The risk to my “strong sell” thesis for Tesla is that Tesla will grow rapidly while maintaining current profit margins, winning in self-driving cars, maintaining EV market share, and long-term growth in AI robotics. I wonder if it can generate big profits.

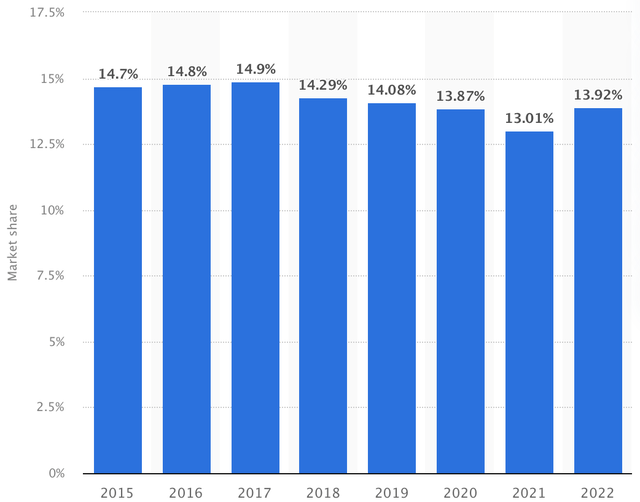

Over the past few years, Ford’s U.S. market share has declined slightly.

Ford’s US market share (Statista)

But Ford’s new products (EV, hybrid, F-150, Broncos) seem to generate excitement, and Ford’s sales have rebounded over the past year. The problem I see is that Ford has also had a number of recalls that could threaten its long-term reputation.

Here is a list of automakers with the most recalls: 2022:

- Ford #1 – 67 Recall

- VW #2 – 45 Recall

- Chrysler #3 – 38 Recall

- Mercedes #4 – 33 Recall

- GM #5 – 32 Recall

- Kia #6 – 24 Recall

- Hyundai #7 – 22 Recall

- Tesla #8 – 20 Recall

- BMW #9 – 19 recalled.

So did Ford Second place in number of recalls It suggests that 2021 may not be focusing enough on quality control. Combined with its leveraged balance sheet, this lowered Ford’s projected growth and terminal multiple.

The conclusion is

Investors are playing a dangerous game with Tesla and Ford. Still, if I had to play, I would beat Ford. With a profit yield of just 1.4%, Tesla could easily face his lost decade. I’d upgrade Tesla stock to $122 a share “Hold,” which equates to a 55% downside. Level 2 autonomous driving alone is losing the autonomous driving race.In fact, experts rank it unranked top 10. Cash flows from EV charging, Tesla bots and EV Semiconductors could also disappoint. For example, Tesla’s EV charging partnership is expected to generate just $3 billion in revenue, not profits, by 2030.

Ford, on the other hand, has the worst number of recalls in 2022 and the most use of its balance sheet among its peers. Still, Ford is generating excitement with its new products, and I think it’s well outperforming Tesla from here on out.

My Rating:

- Ford “Wait”

- Tesla: ‘strong sell’

We currently have a small position in Honda and purchased at $23.50 per share. I like the fact that the company has a solid balance sheet and top market share in things like motorcycles. Click here for more information on Honda. I also recently wrote a purchase article about General Motors here.

Until next time, have fun investing!

Editor’s Note: This article describes one or more securities that are not traded on any major US exchange. Please be aware of the risks associated with these stocks.